February 10, 2022

There are many factors to consider when deciding whether to form a group company structure and if it is right for your new or existing business.

In this article Stephen Thompson of Darwin Gray Solicitors and Andrew Miller of BPU Chartered Accountants advise on the legal, financial and tax implications of forming a group company structure.

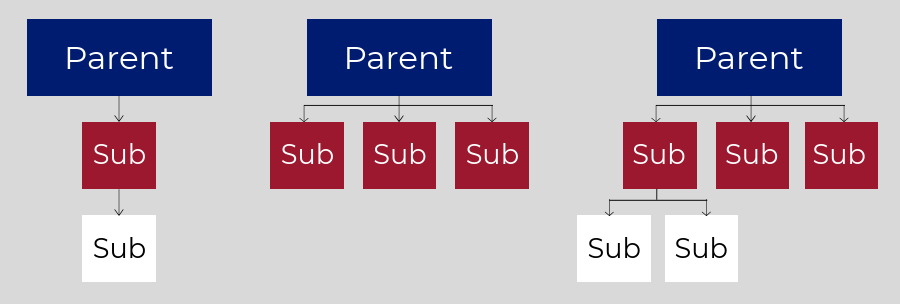

Group structures can take a variety of forms, including vertical and horizontal formats and also hybrid structures, as shown below.

Alternatively, a separate standalone company or companies can be formed with common ownership, but without a formal group structure.

Another option is to have a single company with separate trading divisions.

Why form a group structure?

There can be a number of potential commercial, regulatory, legal and tax benefits in forming a group company structure.

-

Ringfencing assets and liabilities

A subsidiary company can be used to ringfence assets or liabilities, with each company in the group having limited liability.

Therefore, if you intend to launch a new product or expand into a new market, by using a subsidiary for that purpose you can keep the assets of the business in a different group company and therefore safeguard them from the risk of the new business venture. If the new venture is successful then the subsidiary company can build its own brand and reputation independently from the other group companies, but with the benefit of their financial support.

By using a subsidiary company to undertake different activities or hold certain assets (e.g. intellectual property) there may be an administrative or regulatory advantage. It may be possible to extend certain regulatory authorisations to cover other members of the group.

-

Centralised functions and assets

A group company can be used to hold, centrally, certain group assets e.g. property or intellectual property, which can then be used across the other group companies, for example by leasing or licencing them. This allows the group to exploit its assets commercially, whilst endeavouring to protect them from commercial and financial risk.

One of the main advantages of a group structure over separate companies with common ownership is that, subject to various conditions being met, group companies have the benefit of a number of tax exemptions and reliefs between them. These include applying certain tax losses and reliefs across the group, transferring of assets between group companies and also corporation and stamp tax (or Land Transaction Tax in Wales) exemptions.

In the future you may wish to sell part only of your business. A group company structure may help you to do so, particularly if you want to retain part of the business for future generations.

Other potential advantages include making corporate pension contributions, extracting dividends more efficiently and also rewarding key employees in one company without affecting other companies.

The process of forming a group, with the benefit of proper accounting, tax and also legal advice, is not as complicated or expensive as you might imagine. It may well be worth considering doing so to take advantage of some of the potential benefits outlined above.

The creation of a group strcuture can be done tax free in the vast majority of cases, and is often used in succession planning scenarios if a buiness partner is looking to exit.

Furthermore, assurance can be sought from HMRC, in advance of beginning the process, to provide certainty to the individuals and companies involved that no tax will be due.

If you would like some further guidance, and for a free, no obligation conversation about how we can help you with the above, please contact Stephen Thompson on 07970160166 or sthompson@darwingray.com.

What are the Benefits of a Group Company Structure?

What are the Benefits of a Group Company Structure?